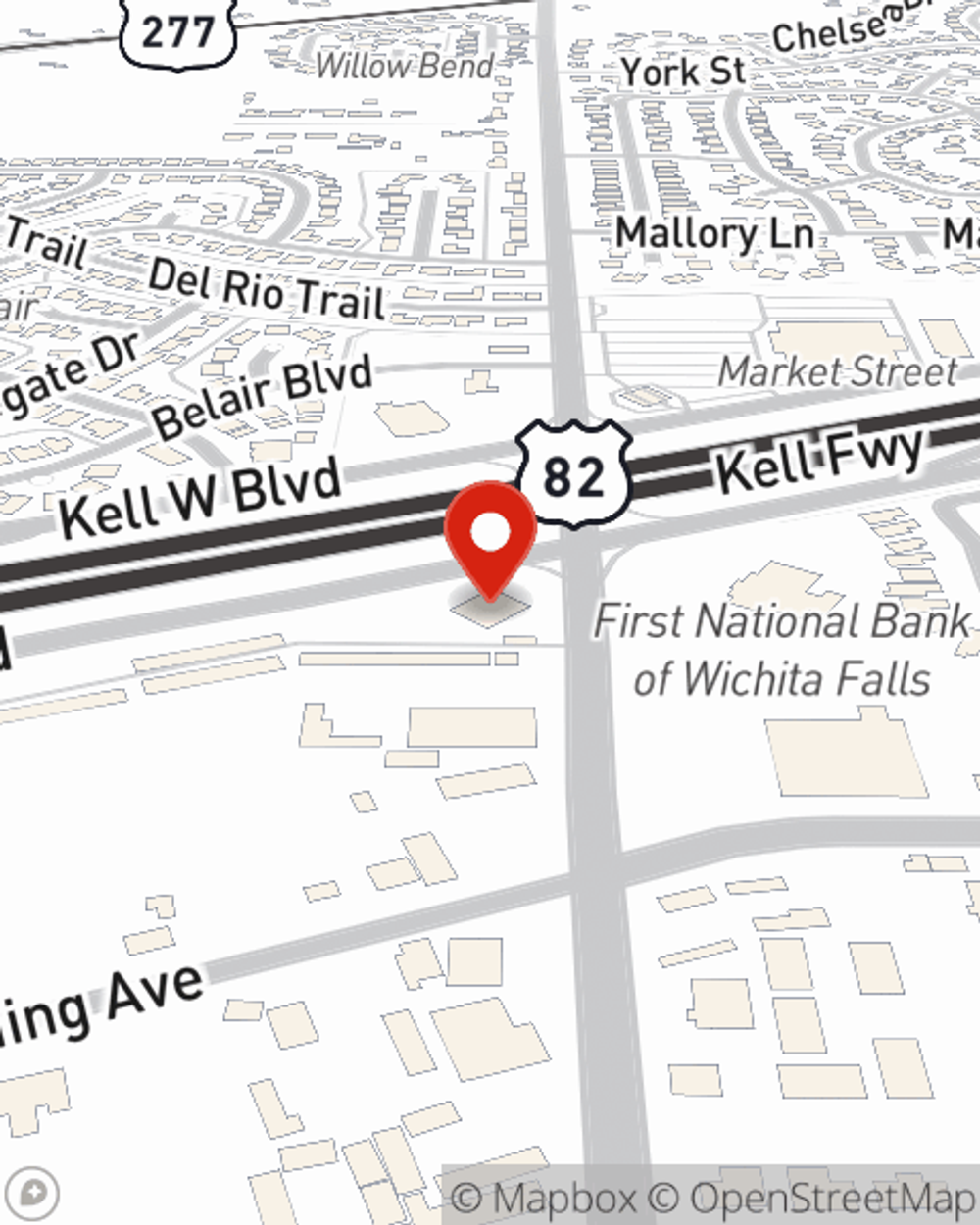

Business Insurance in and around Wichita Falls

Searching for protection for your business? Look no further than State Farm agent Mindy Anderle!

Almost 100 years of helping small businesses

State Farm Understands Small Businesses.

As a small business owner, you understand that the unexpected happens. Unfortunately, sometimes accidents like a customer hurting themselves can happen on your business's property.

Searching for protection for your business? Look no further than State Farm agent Mindy Anderle!

Almost 100 years of helping small businesses

Cover Your Business Assets

Planning is essential for every business. Since even your most detailed plans can't predict product availability or global catastrophes. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for uncertainty with a State Farm small business policy. Business insurance protects more than just your facility or shop.. It protects your hard work with coverage like worker's compensation for your employees and a surety or fidelity bond. Terrific coverage like this is why Wichita Falls business owners choose State Farm insurance. State Farm agent Mindy Anderle can help design a policy for the level of coverage you have in mind. If troubles find you, Mindy Anderle can be there to help you file your claim and help your business life go right again.

Intrigued enough to investigate the specific options that may be right for you and your small business? Simply call or email State Farm agent Mindy Anderle today!

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Mindy Anderle

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.